Additional $450,000 in Matching Loans Available for Relief for Hard-Hit Businesses

Startup Junkie Foundation will expand its Kiva offerings in Northwest Arkansas to help small business owners access much-needed capital during the COVID-19 crisis. The program will now have an additional $450,000 in matching no-fee, no-interests loan funds for every new, approved small business borrower in Washington and Benton counties. Approved borrowers looking for capital to react or recover from COVID-19 will be able to have up to 75 percent of their loan matched by these additional funds. The program expansion is supported through a grant from the Walton Family Foundation.

“Over the last few weeks, we have been working daily to establish this new loan matching fund so our struggling small business owners can quickly access the capital they so desperately need,” said Martha Londagin, NWA Kiva Hub Capital Access Manager.

Small business owners interested in applying for a crowdfunded Kiva loan must contact Martha Londagin at fayetteville@local.kiva.org or (479) 276-7096.

In December, Startup Junkie Foundation launched the state’s first official Kiva Hub in Northwest Arkansas, a local resource center by which entrepreneurs and small business owners can access the Kiva platform to obtain no-fee, no-interest microloans of up to $10,000 from a community of local and national lenders. The resources were made possible with funding from the Walton Family Foundation, which included $100,000 in dollar-for-dollar matching funds for borrowers in Washington and Benton counties to help them reach their goal faster.

Loans granted through Kiva are made up of five to 20 initial, private contributions of as little as $25, from customers, friends and family, before launching to the national community of lenders.

In response to COVID-19, Kiva U.S. has adjusted its small business lending program to expand eligibility and increase loan sizes.

Key changes in the Kiva U.S. loan program in response to COVID-19 include:

-

Expanded eligibility: More businesses in the U.S. will be eligible for a Kiva loan for working capital needs.

-

Larger loans: The maximum loan offering on the Kiva platform will increase from $10,000 to $15,000 for existing businesses operating for two years or more; those in business less than one year up to $3,000, and those in business 1-2 years $3500 to $6000.

-

Grace period: All new borrowers affected by the COVID-19 crisis may access a grace period of up to 6 months for greater financial flexibility.

-

Regular Terms: All loans will continue to be a 0% interest rate with no fees charged due to Kiva being a nonprofit, online, public, crowdfunding platform entity. PayPal is required as its services are donated at no charge to Kiva, its approved borrowers, and community lenders. Monthly repayment terms are 12-36 months.

-

Click here for the organization’s complete crisis response for borrowers and lenders.

The additional $450,000 in funds will be divided between Startup Junkie Foundation and Kiva. Funding allocated to Startup Junkie Foundation will be placed in a lender fund to provide 25 percent of the loan goals of new, approved Kiva borrowers. Funds distributed to Kiva will be used for dollar-for-dollar loan matching, providing half of the stated loan goal. New, approved borrowers will only be required to raise 25 percent of their goal from the community before funds from both entities are activated.

Each business must be able to provide basic business proof documents, such as a business bank account statement, business license, or dba certificate copy.

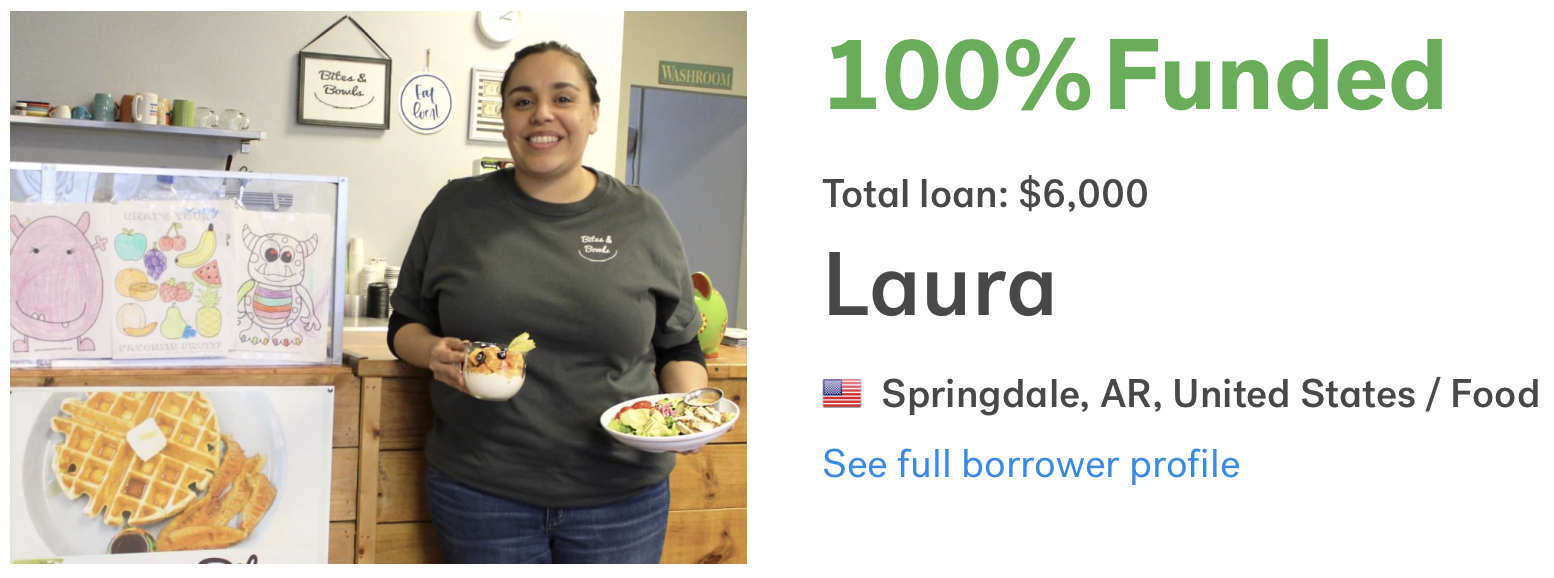

Laura, of Bites & Bowls in Springdale, was the first Kiva NWA borrower launched. She was fully funded in less than a day.

“We have already seen the impact this program can have on small business owners, even in just a short amount of time,” said Londagin. “These are truly loans that change lives. I believe we can make a difference in our small business community during this time of uncertainty.”

Since kicking off in December, the Kiva NWA Hub has helped launch eight local borrowers, all of whom were fully funded in a matter of days, some in hours. More than $56,000 has been borrowed through the local hub to date.

The repayment rate for Kiva loan borrowers is approximately 78 percent in the U.S. Through Kiva NWA, Startup Junkie Foundation provides technical assistance to borrowers and small business owners, including assistance with the application process, working with them step-by-step to increase the likelihood of Kiva approval. While lenders can find U.S. borrowers through Kiva without going through the Hub, having a local partner like the Startup Junkie Foundation and the Kiva Capital Access Manager (CAM) increases the likelihood of success for local entrepreneurs and business owners.

“I believe that a model where a local organization works with Kiva and is funded by a local foundation sets a great precedent for other cities to follow,” said Sarah Adeel, Kiva regional manager for the west and south-central United States. “It is the most innovative way for cities to offer financial inclusion to their small businesses… It will help scale the impact through multiple stakeholders focused on solving a problem together, as well as building a local lending community.”

###

About Kiva: Kiva is an international nonprofit based in San Francisco that connects entrepreneurs and small business owners with local lenders. Loans granted through Kiva are made up of five to 20 initial, private contributions of as little as $25, from customers, friends and family, before launching to the national community. These loans are offered at zero percent interest with no fees. The process requires no credit score, collateral pledges or U.S. citizenship documentation. Visit kiva-nwa.org for more information about Kiva NWA. Visit Kiva.org to view existing borrower profiles.

About Startup Junkie Foundation: Startup Junkie Foundation is a team of passionate people working every day to help entrepreneurs win and communities thrive. We exist to educate, inspire, and support entrepreneurs and innovators through no-cost, one-on-one consulting; events, workshops, and programs; and access to capital and talent.

April 21, 2020

CONTACT: Martha Londagin – NWA Kiva Hub Capital Access Manager

fayetteville@local.kiva.org • 479-276-7096

CONTACT: Caleb Talley – Director of Marketing

caleb@startupjunkie.org • 870-270-3988