From the Arkansas Department of Public Safety:

The Small Business Administration (SBA) Economic Injury Disaster Loan program has been made available to eligible businesses and private non-profits that were impacted by the Coronavirus (COVID-19). Any such Economic Injury Disaster Loan assistance declaration issued by the SBA makes loans available to small businesses and private non-profit organizations in designated counties of the state (county by county). SBA’s Office of Disaster Assistance will coordinate with the state to submit the request for Economic Injury Disaster Loan Assistance.

These working capital loans of up to $2 million can be used to pay fixed debts, payroll, and other bills that can’t be paid because of the disaster’s impact. The interest rate is 3.75% for small businesses without credit available elsewhere; businesses with credit available elsewhere are not eligible. The interest rate for non-profits is 2.75%. The SBA offers loans with long-term repayments in order to keep payments affordable, up to a maximum of 30 years. Terms are determined on a case-by-case basis, based upon each borrower’s ability to repay.

In order to receive an economic injury declaration, Arkansas must show that small businesses within individual counties have suffered substantial economic injury as a result of the disaster and are in need of financial assistance not otherwise available on reasonable terms. The method to determine the impacts of the disaster is through the collection of Economic Injury Disaster Loan worksheets. This worksheet provides an estimated economic impact of each business affected.

The Estimated Adverse Economic Impact Section of the Economic Injury worksheet needs to be fully completed, with all questions answered regarding business revenues, whether there was any business interruption insurance, as well as the comments section. The comments section should indicate that the economic impacts are a direct result of COVID-19. The established incident start date is January 31, 2020.

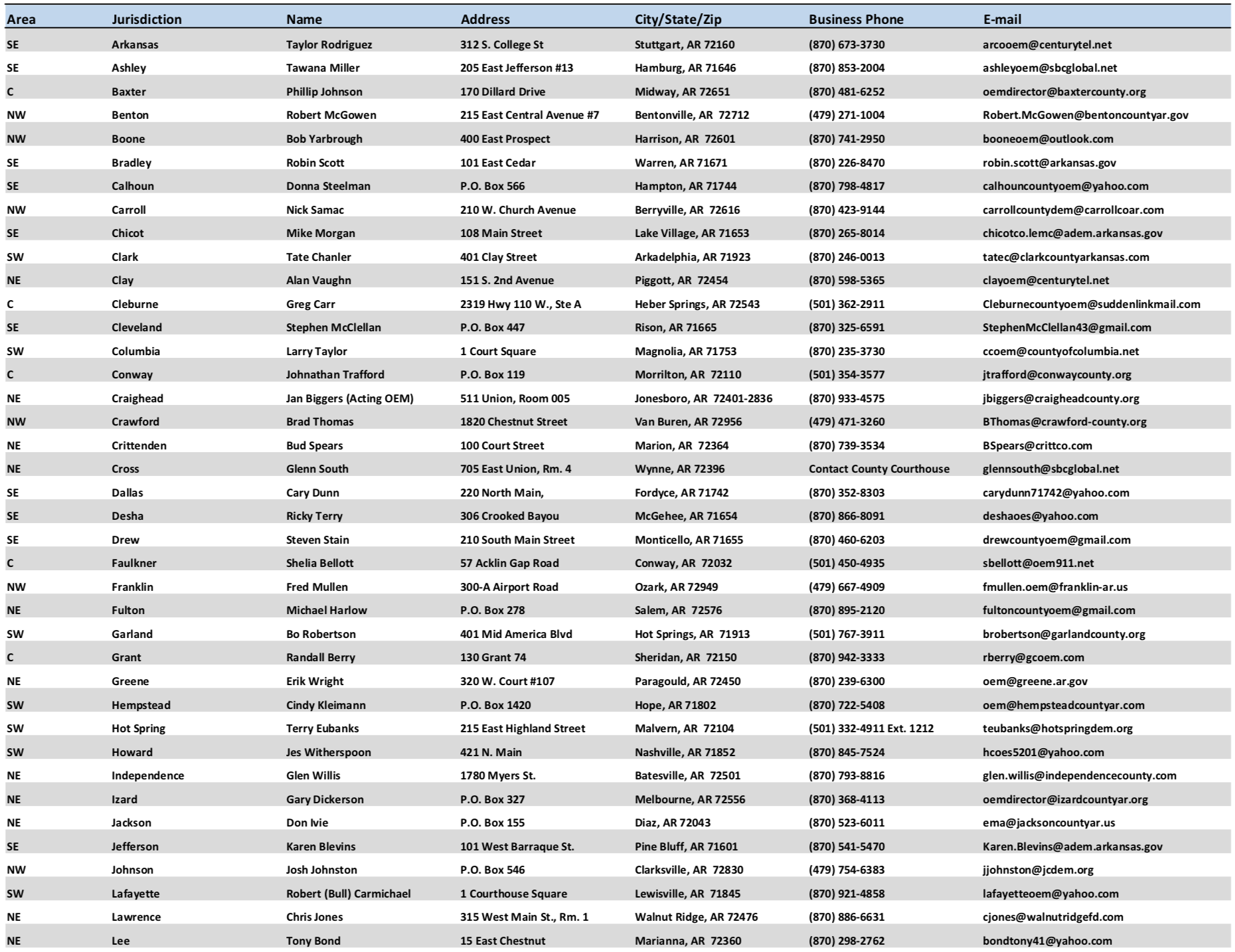

The completion of this worksheet is not an application for an SBA loan; however, the completion and submittal of the worksheet to the Arkansas Division of Emergency Management will assist the state in receiving a declaration from SBA. Impacted businesses and private non-profits must fill out the worksheet and return the completed forms to the Arkansas Division of Emergency Management at businesscovid19@adem.arkansas.gov. The timely submission of the worksheets will assist in a timely SBA declaration of each county.

Step one: Complete the U.S. Small Business Administration’s “Estimated Disaster Economic Injury Worksheet for Business”

Step two: Email the completed “Estimated Disaster Economic Injury Worksheet for Business” to businesscovid19@adem.arkansas.gov

Optional: Copy team@startupjunkie.org to help Startup Junkie assess local impact

Once a declaration is made for designated areas within the state, the information on the application process for Economic Injury Disaster Loan assistance will be made available to all affected communities as well as updated on the SBA and ADEM websites.

Access the worksheet by clicking here. Please send any questions and completed worksheets to businesscovid19@adem.arkansas.gov.